XBI: Understanding The Impact Of Exchange-Traded Funds On Your Investment Strategy

In the world of investment, Exchange-Traded Funds (ETFs) have emerged as a significant player, offering a myriad of opportunities for both novice and seasoned investors. One such ETF that has gained attention is the XBI, which focuses on the biotechnology sector. This article delves deep into XBI, its structure, performance, and how it can fit into your investment portfolio.

The biotechnology sector is known for its rapid innovation and potential for high returns, making XBI an attractive option for investors looking to diversify their portfolios. However, investing in biotechnology also comes with its risks due to the inherent volatility of the sector. Understanding XBI is crucial for making informed investment decisions.

This article will provide a comprehensive overview of XBI, including its benefits, risks, and performance metrics. Additionally, we will explore how to effectively incorporate XBI into your overall investment strategy, ensuring you are well-equipped with the knowledge needed to navigate this dynamic sector.

Table of Contents

- Introduction

- What is XBI?

- Overview of the Biotech Sector

- Benefits of Investing in XBI

- Risks Associated with XBI

- XBI Performance History

- How to Invest in XBI

- Conclusion

What is XBI?

XBI, or the SPDR S&P Biotech ETF, is an exchange-traded fund that tracks the performance of the S&P Biotechnology Select Industry Index. It aims to provide investment results that correspond to the total return of this index, which is composed of biotechnology companies listed on U.S. stock exchanges.

Key Features of XBI

- Diversification: XBI invests in a wide range of biotechnology companies, providing investors with exposure to different facets of the biotech industry.

- Liquidity: Being an ETF, XBI trades on major stock exchanges, allowing investors to buy and sell shares throughout the trading day.

- Low Expense Ratio: XBI typically has a lower expense ratio compared to actively managed funds, making it a cost-effective investment option.

Overview of the Biotech Sector

The biotechnology sector is at the forefront of medical and technological advancements, focusing on the development of drugs, therapies, and medical devices. It encompasses a wide range of fields, including genomics, pharmaceuticals, and diagnostics.

Current Trends in Biotechnology

- Gene Therapy: Innovations in gene editing technologies like CRISPR are transforming the treatment landscape.

- Immunotherapy: Cancer treatment is evolving with the rise of immunotherapies that harness the body's immune system.

- Personalized Medicine: Tailoring treatments based on individual genetic profiles is becoming more prevalent.

Benefits of Investing in XBI

Investing in XBI offers several advantages, particularly for those interested in the biotechnology sector.

Diversification Benefits

By investing in XBI, investors gain exposure to a diversified portfolio of biotech companies, which can mitigate the risks associated with investing in individual stocks.

Potential for High Returns

The biotech sector has historically shown significant growth potential, with many companies developing groundbreaking therapies and products that can lead to substantial returns for investors.

Risks Associated with XBI

While XBI presents numerous advantages, it is essential to be aware of the risks involved in investing in biotechnology ETFs.

Market Volatility

The biotech sector is known for its volatility, often driven by regulatory approvals, clinical trial results, and market sentiment. This can lead to sharp declines in stock prices.

Regulatory Risks

Biotechnology companies are subject to extensive regulations, and any changes in government policies can significantly impact their operations and stock performance.

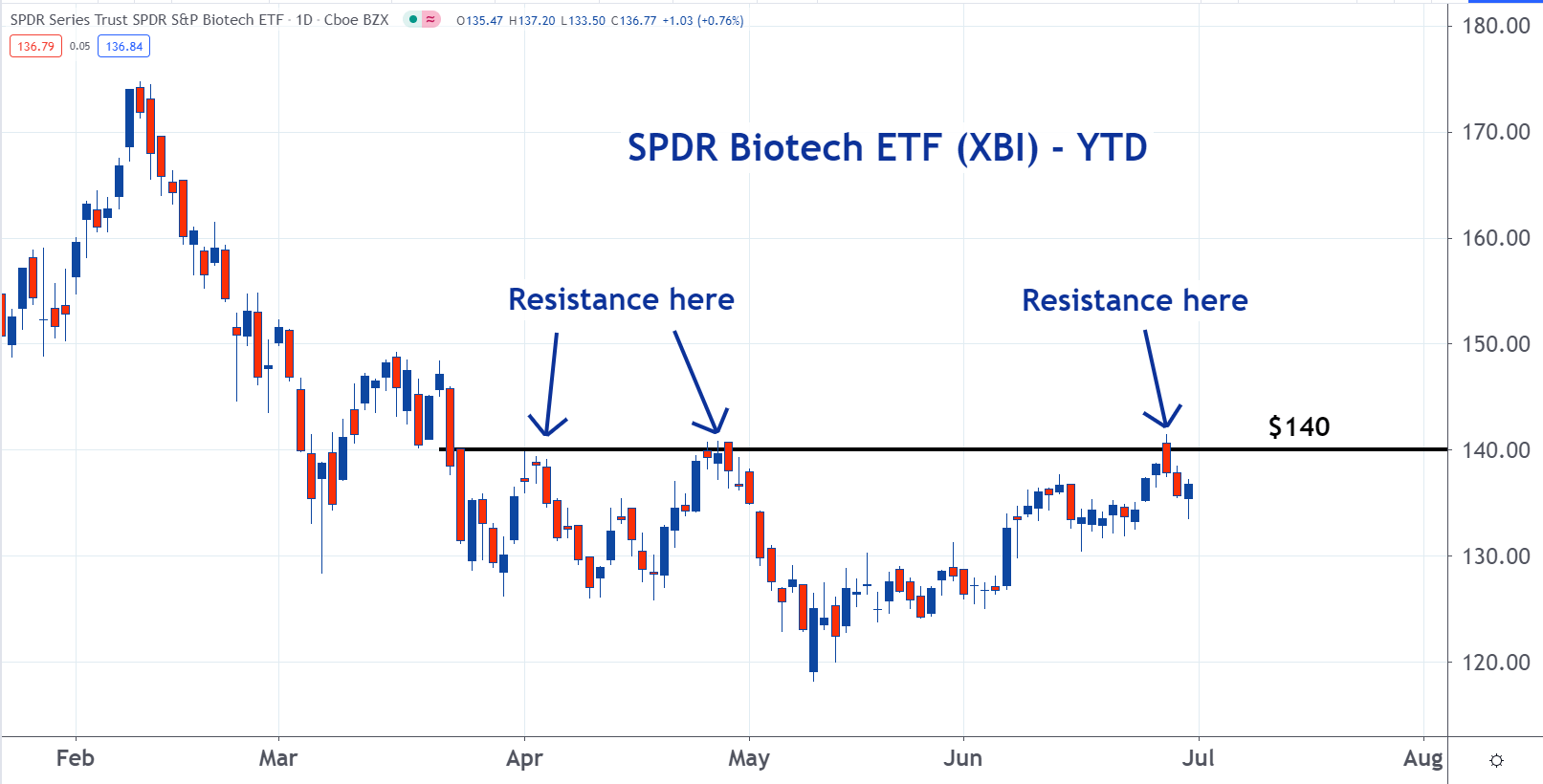

XBI Performance History

Understanding the historical performance of XBI can provide insights into its potential future performance.

Return Metrics

XBI has shown impressive returns over the past decade, outperforming many traditional indices. However, it is crucial to analyze performance in the context of market conditions and sector-specific developments.

Comparative Analysis

When compared to other ETFs in the healthcare sector, XBI has consistently delivered competitive returns, making it a preferred choice for biotech investors.

How to Invest in XBI

Investing in XBI is straightforward, but it's essential to approach it with a well-defined strategy.

Choosing a Brokerage

Selecting the right brokerage is crucial for purchasing XBI shares. Look for platforms that offer low commissions and a user-friendly interface.

Establishing an Investment Strategy

Consider your investment goals, risk tolerance, and time horizon when investing in XBI. A well-thought-out strategy can enhance your chances of success.

Conclusion

XBI represents an exciting opportunity for investors looking to tap into the growth potential of the biotechnology sector. With its diversified portfolio and the potential for high returns, XBI can be a valuable addition to your investment strategy. However, investors must remain vigilant about the risks involved and stay informed about market trends and company developments.

Engage with us by sharing your thoughts in the comments below or exploring other insightful articles on our site to enhance your investment knowledge!

Final Thoughts

Thank you for taking the time to read this article on XBI. We hope this information empowers you to make informed investment decisions in the biotechnology sector. Remember to return for more articles that can help you navigate the complexities of investing.

David Eigenberg: A Journey Through His Life And Career

Exploring The Life And Career Of Simon Helberg

Unraveling The Mystery Of The Postcard Killings: A Comprehensive Analysis